cumulative preferred stock dividends in arrears

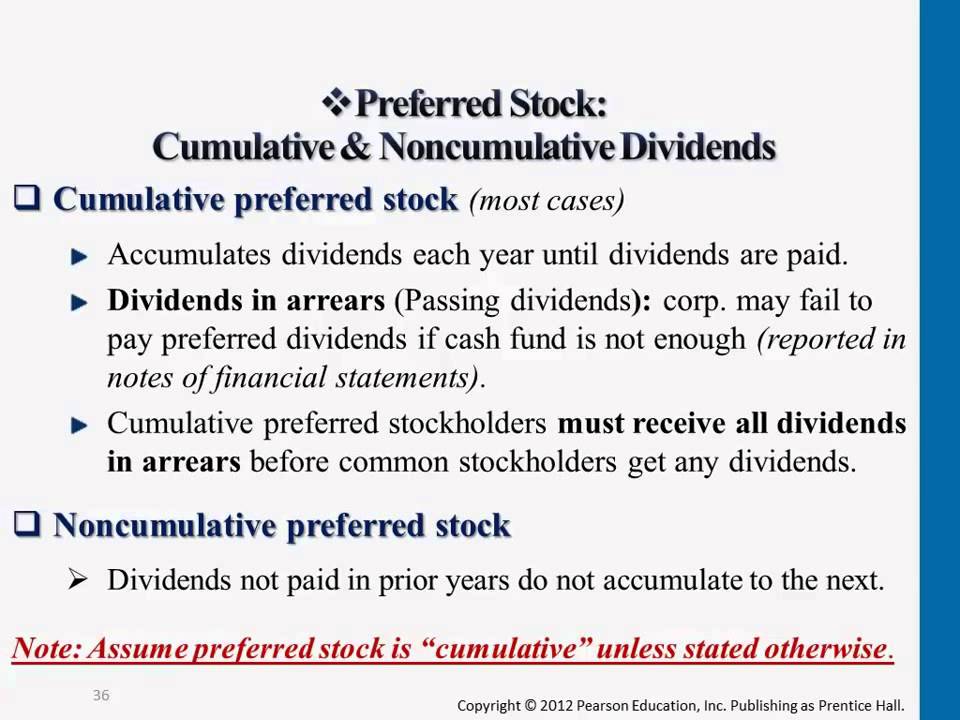

Dividends in arrears are dividend payments that have not yet been paid on cumulative preferred stock also known as preference shares. These dividends have not been authorized by the board of directors because the issuing entity does not.

Preferred Stock And Common Stock Dividend Allocations Youtube

In this case cumulative refers to the fact that these dividends will accumulate until payment.

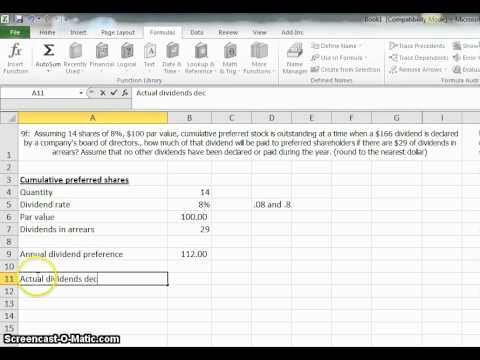

. Pay any dividends in arrears. If a firm is unable to pay the dividend on time they must accumulate sufficient funds until it can make the payment. Cumulative preferred stock A requires dividends in arrears to be carried over.

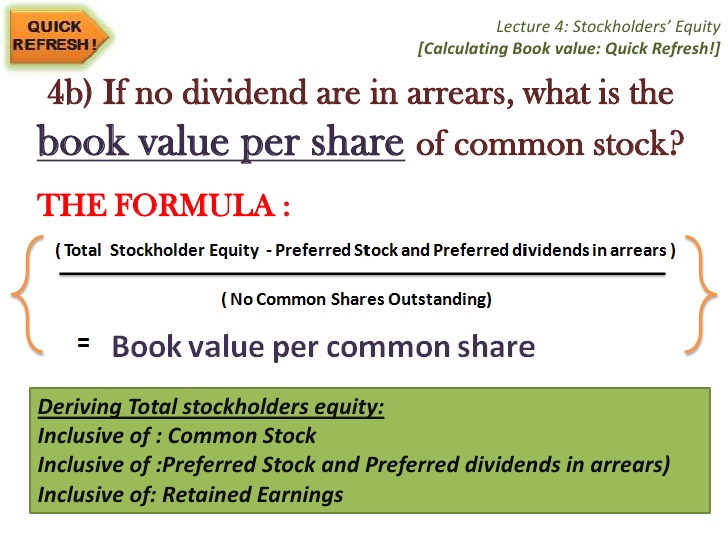

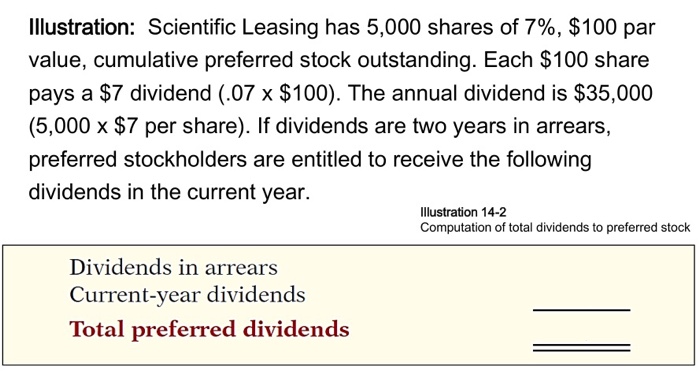

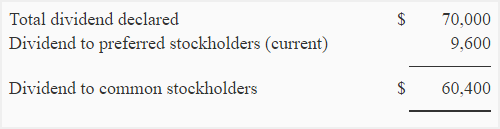

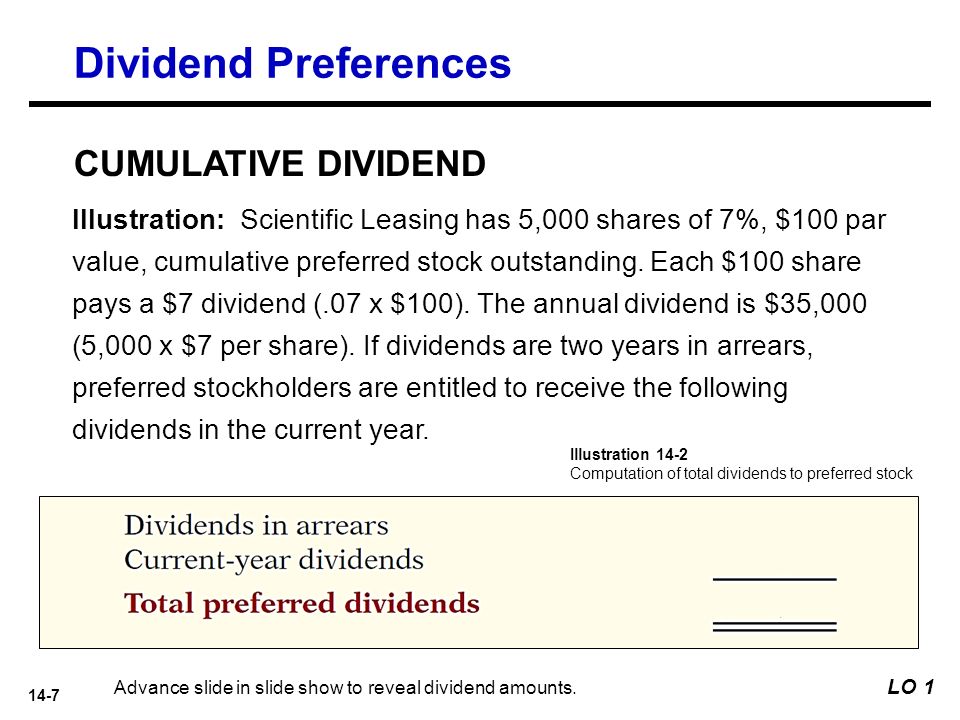

Continuing the example multiply 10 by 100000 to get 1 million in total dividends in arrears. What is a Cumulative Dividend. A dividend in arrears is a dividend payment associated with cumulative preferred stock that has not been paid by the expected date.

Preferred stock dividends are typically expressed as a. Omitted past dividends on the cumulative preferred stock and the amount has not yet been paid. Cumulative preferred stock a requires dividends in.

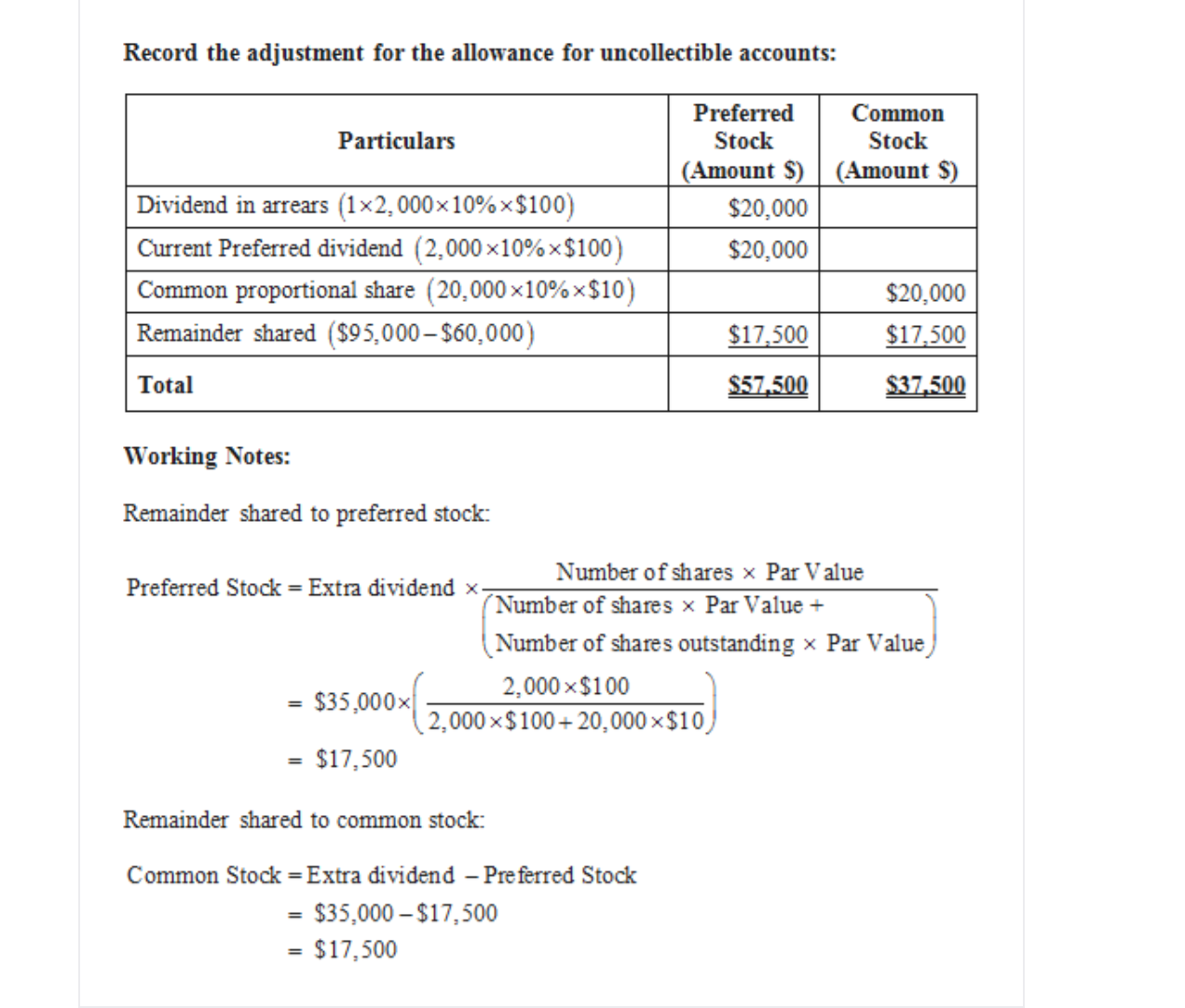

If the corporation wants to pay any dividends to its common and preferred stockholders it must do the following. Suppose a company has 10000 8 preference shares of Rs. Cumulative preferred stock is also called cumulative preferred shares.

Dividends in arrears exist when a corporation has. The disclosure of dividends in arrears is an important financial indicator for investors and other users of financial statements. Furthermore you can find the Troubleshooting Login Issues section which can answer.

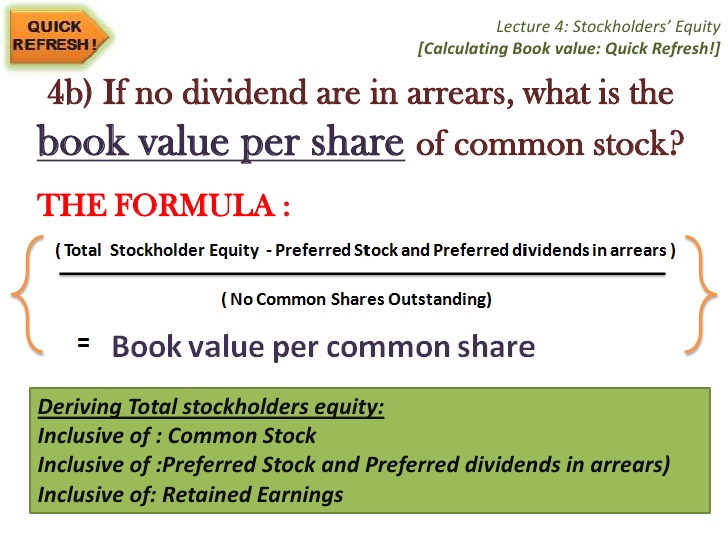

Dividends in arrears on cumulative preferred stock enable the preferred stockholders to share equally in corporate earnings with the common stockholders. Dividends in arrears on cumulative preferred stock a are shown in stockholders from ACC 557 at Strayer University. Such disclosure is made in the form of a balance sheet note.

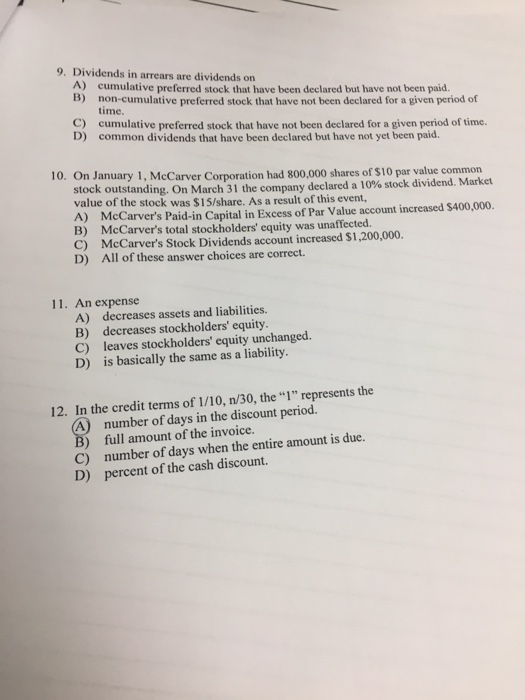

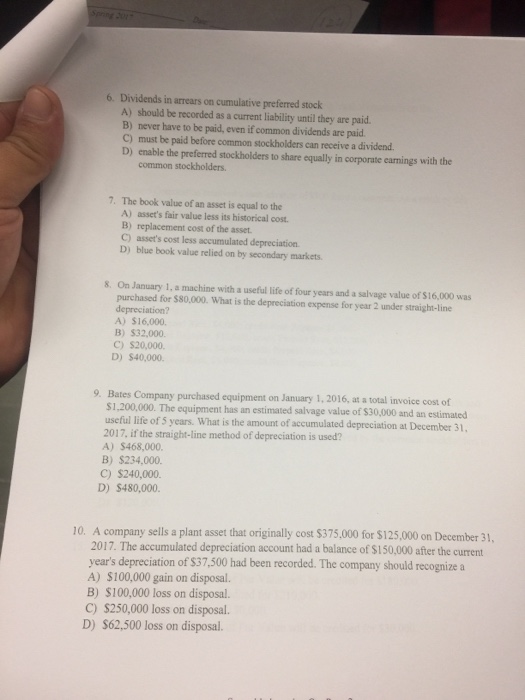

Cumulative preferred stock contains a provision requiring that any missed dividend payments be paid out to cumulative preferred shareholders first before any other shareholders such as common shareholders. Dividends in arrears are dividends on. O cumulative preferred stock that have been declared but have not been paid.

Holders of shares of the FixedAdjustable Rate Cumulative Preferred Stock are entitled to receive dividends at a rate per annum equal to 050 plus the highest of the Treasury Bill Rate the Ten Year Constant Maturity Rate and the Thirty Year Constant Maturity Rate as each term is defined in the certificate of designation establishing the. A preference share is said to be cumulative when the arrears of dividend are cumulative and such arrears are paid before paying any dividend to equity shareholders. Which is not the preference share type.

Non-cumulative preferred stock that have not been declared for a given period of time. First determine the dollar amount of each of your preferred shares fixed quarterly dividends. Dividends in arrears on cumulative preferred stock.

If the prospectus says the preferred stock is non-cumulative there will be no dividends in arrears. Once all cumulative shareholders receive. B The value of the preferred stock is 7 because the dividend is fixed at 7 each year.

Any unpaid dividend on preferred stock for an year is known as dividends in arrears. Journal Entries Because you must pay the dividends in arrears first record the cumulative preferred dividend payment by debiting Dividends Payable-Cumulative Preferred Dividend Arrearage for 10000 and crediting Cash for 10000. Accounting For Cumulative Preferred Dividends will sometimes glitch and take you a long time to try different solutions.

Cumulative preferred stock that have not been declared for a given period of time. This means the company must pay 1 million to cumulative preferred stockholders when it declares a new dividend before paying any dividends to common stockholders and before paying a new dividend to cumulative preferred stockholders. C The value of the preferred stock is 6300 per share.

A The value of the preferred stock is 7778 per share. Ad Search Ex-Dividend Dates Dividend Calendar All-Star Rankings More. Cumulative preferred stock A requires dividends in arrears to be carried over from FIN 3302 at Texas AM University Corpus Christi.

Cumulative dividends are required dividend payments made by a firm to its preferred shareholders. Common dividends that have been declared but have not yet been paid. Find Todays Best Dividend Stocks Ex-dividend Dates and Stock Data.

Disclosure of dividends in arrears on cumulative preferred stock. Cumulative dividends must be paid even if they are paid at a later date than originally stated. D The value of the preferred stock is 630 per share because of the 9 required return.

Definition of Dividends in Arrears. LoginAsk is here to help you access Accounting For Cumulative Preferred Dividends quickly and handle each specific case you encounter. Generally preferred stock will trade with a higher yield than the same companys bonds to make.

Preferred stocks such as cumulative preferred stocks often resemble bonds related to valuation. Are considered to be a non-current liability. The cumulative preferred stock shareholders must be paid the 900 in arrears in addition to the current dividend of 600.

Compute Preferred Dividend On Cumulative Preferred Stock With Dividends In Arrears Youtube

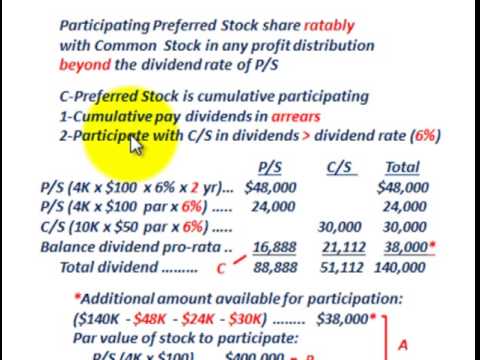

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube

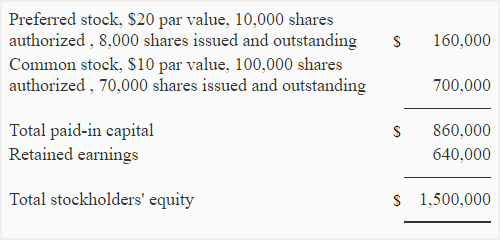

Corporations Paidin Capital And The Balance Sheet Chapter

Preferred Stock Cumulative Noncumulative Dividends Youtube

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

How Are Dividends Paid When There Are Dividends In Arrears Accounting Services

Solved Illustration Scientific Leasing Has 5 000 Shares Of Chegg Com

Dheeraj On Twitter Dividends In Arrears In Cumulative Preferred Stocks Definition Https T Co U8m0grh9hc Dividendsinarrears Https T Co 8wwb2ppsys Twitter

Solved Dividends In Arrears On Cumulative Preferred Stock Chegg Com

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

14 Corporations Dividends Retained Earnings And Income Reporting Ppt Download

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Answered A Corporation S Shareholders Are Not Bartleby

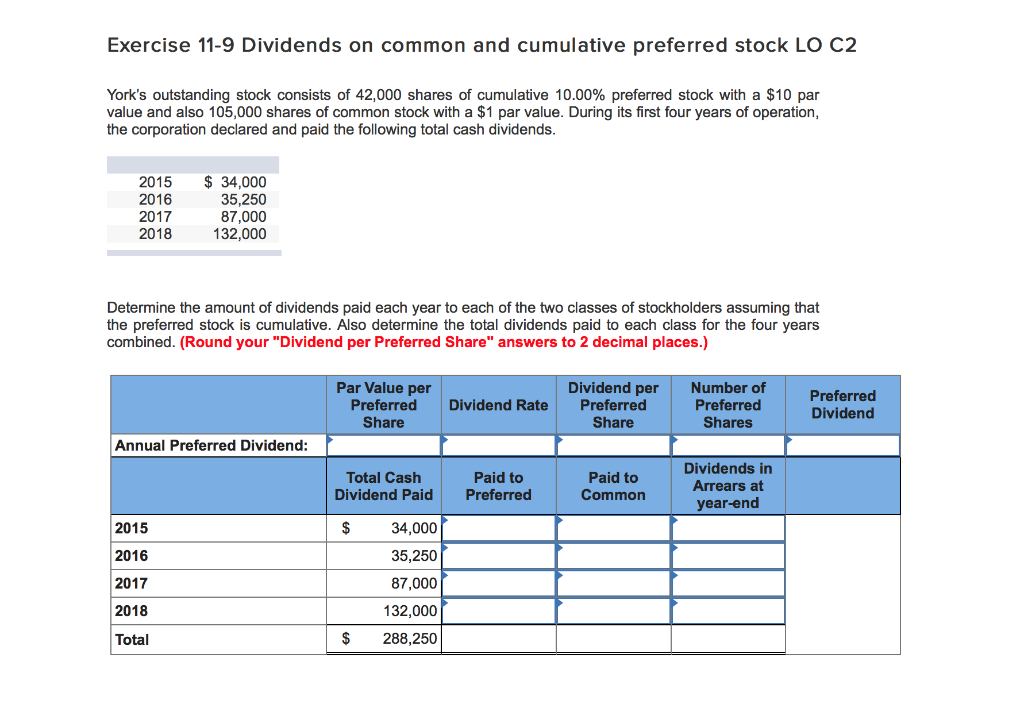

Solved Exercise 11 9 Dividends On Common And Cumulative Chegg Com

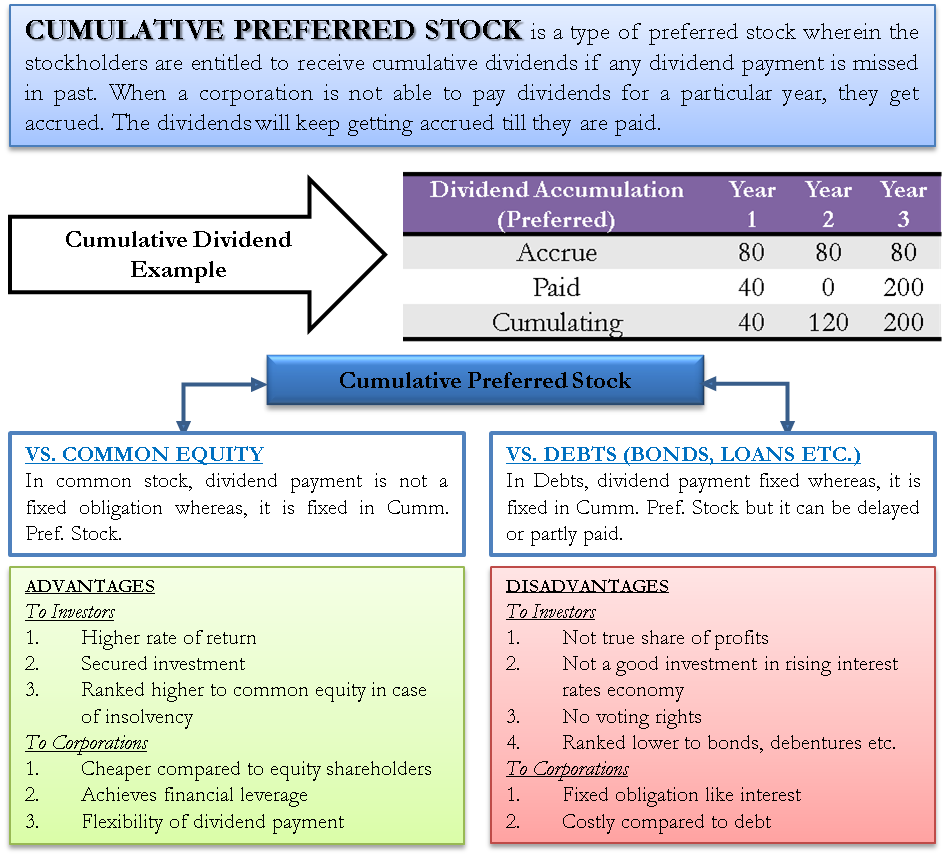

Cumulative Preferred Stock Define Example Benefits Disadvantages

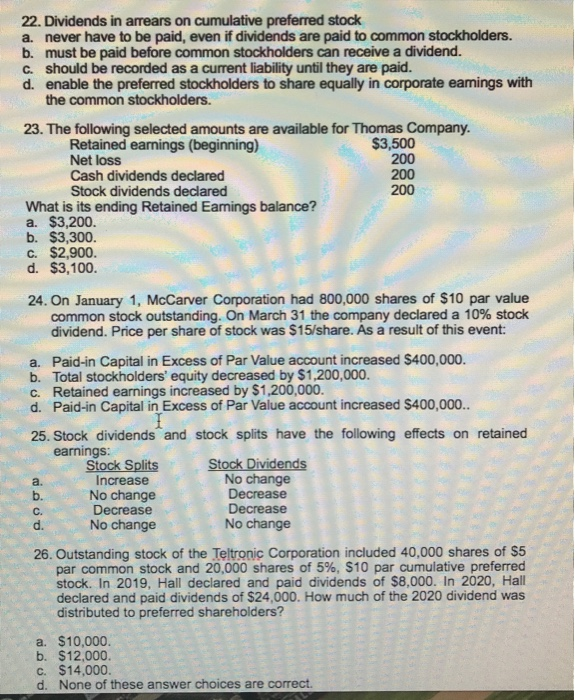

Solved 22 Dividends In Arrears On Cumulative Preferred Chegg Com